Blog

Opportunity is Knocking…

Finance Today

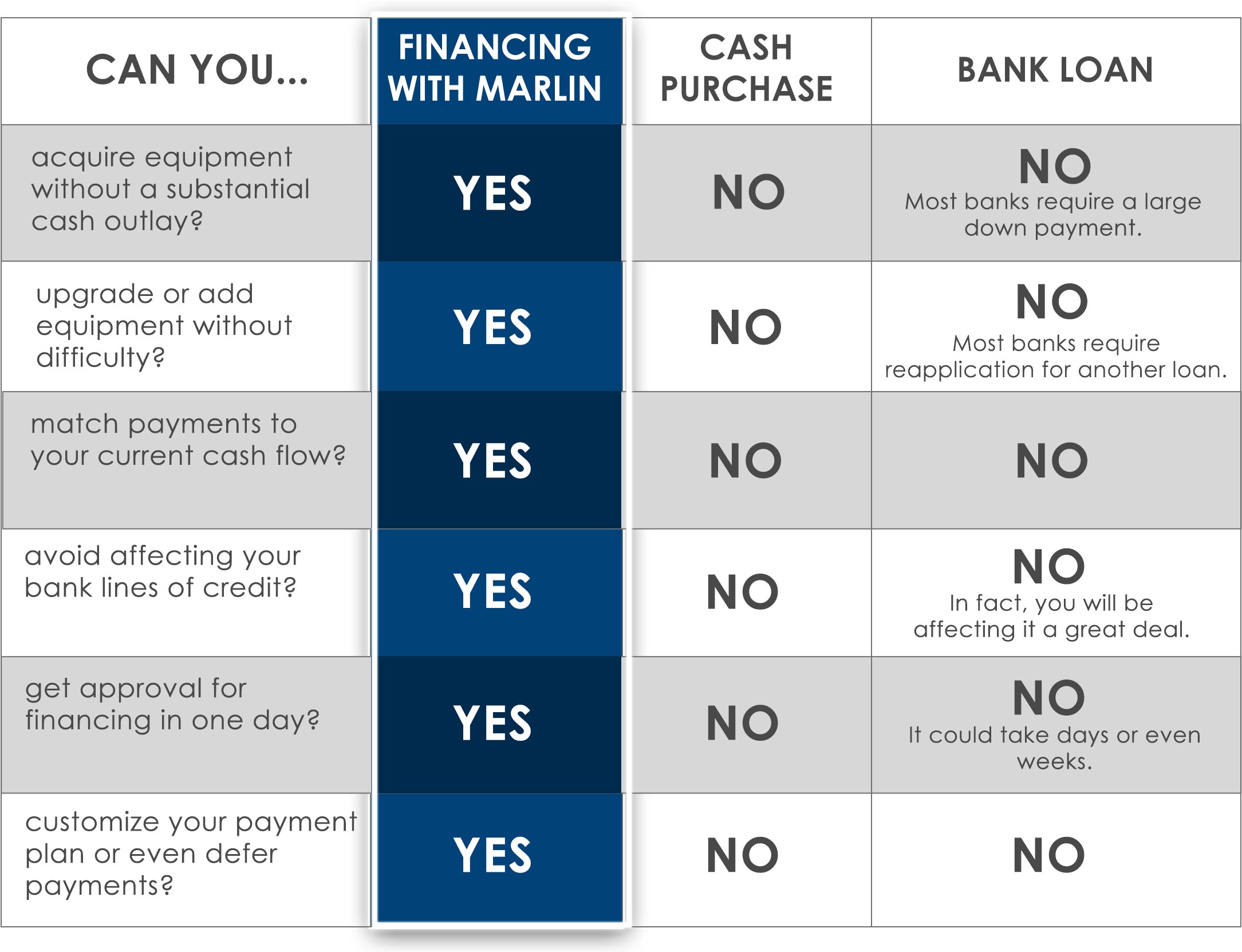

Advantages of Financing with Marlin

Effective cash flow management is an extremely important element to a successful business - small or large. Equipment financing offers business owners a means to acquire equipment based on an operating budget - not based on capital or cash on hand.

100% Financing

Unlike some loan programs, you can finance 100% of your equipment.

Flexibility

As businesses grow and need change, you will be able to add or upgrade equipment at any point during the financing term.

Asset Management

Financing provides the use of equipment for specific periods of time at fixed payments. The financing company assumes and manages the risk of equipment ownership. At the end of the term, if you elect to return the equipment, the financing company is responsible for the disposition of the asset.

Tax Advantages

There are tax incentives for purchasing new equipment. By financing your equipment, the amount you save in taxes could be greater than what you pay in the first year of a lease. Their new equipment could make you money from day one!

Logic of Financing

5 Easy Steps

Shop

Find the equipment or software solution you need for your business.

Apply

Complete a simple credit application.

Once the application is complete, we will begin the credit approval process and have an answer to you within two hours.

Sign

Upon approval, sign one page finance agreement.

Reveive

Upon receivin your equipment or software, Marlin will commence the finance agreement.

Pay

Once the finance agreement is commenced, your first invoice will arrive within 30 days and you will be billed monthly for the duration of your finance term.